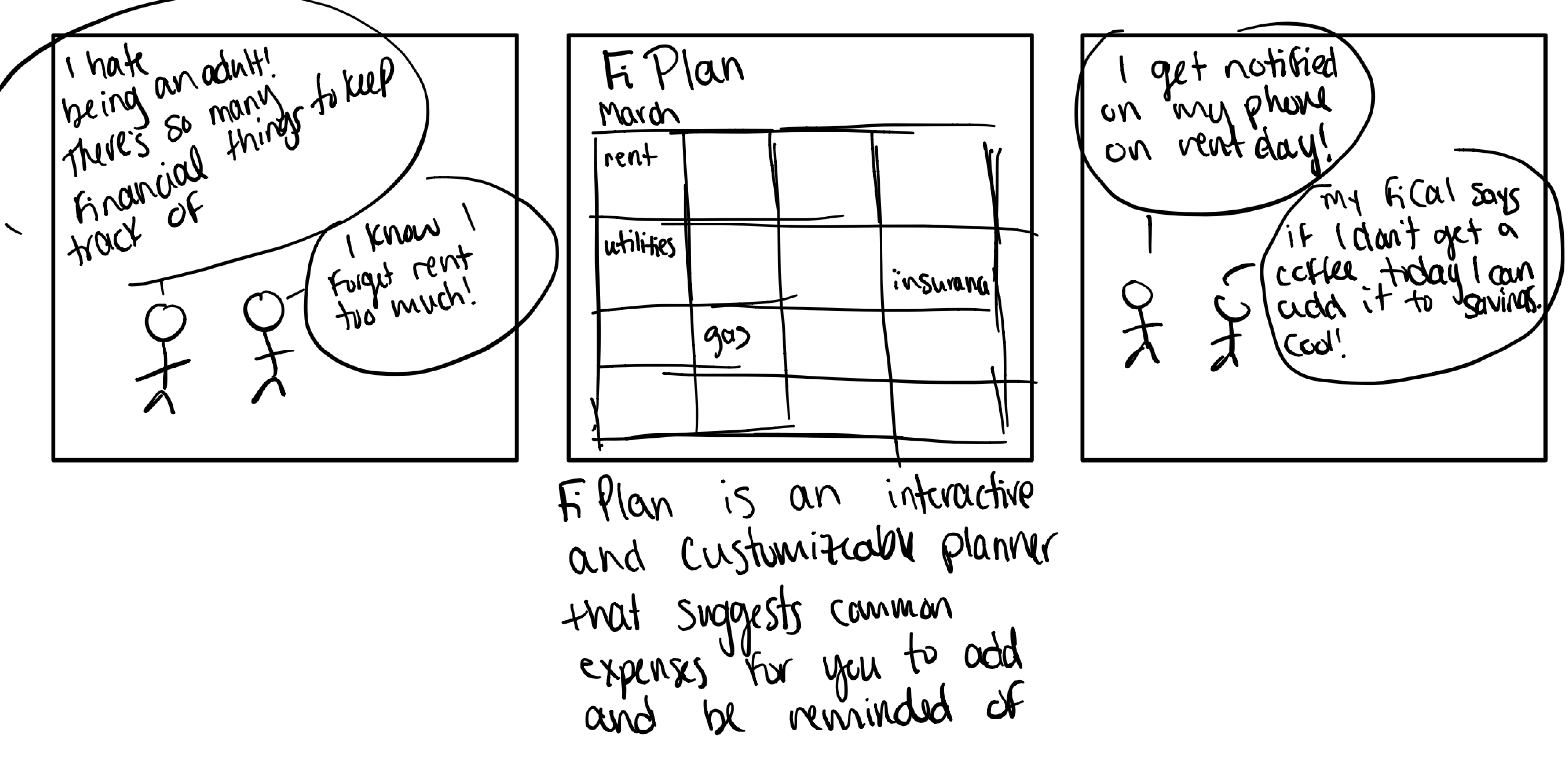

Roots

Ideation / UI/UX Design + UX Research

DURATION: January - May 2021

COLLABORATORS: Ginny Zhao, Hannah Fernandes, Shai Bhardwaj

CONTEXT: 05-410: User-Centered Research & Evaluation Final Project

In the Spring of 2021, I took User-Centered Research and Evaluation, an HCI course focused on learning the tools and techniques used in HCI study as well as the value of evaluative and generative research methods. Our task over the course of the semester was to use the methods and techniques we learned to innovate on this question: How might we make the home-buying process less intimidating and more seamless for young adults?

Methods

Semi-structured Interviews

Affinity Diagramming

Storyboarding

Powers of Ten

Stakeholder Journey Mapping

Customer Journey Mapping

Think Aloud Study

Artifact Analysis

Usability Testing

Speed Dating

Wireframing

Experience Prototyping

Elevator Pitch

Tools

Figma

LucidChart

Slack

Stakeholder + Customer Journey Maps

Prior to forming teams, we were individually tasked with conducting background research into the topic of home-buying and create stakeholder and customer journey maps based on those findings.

For my stakeholder journey map, I began by researching the roles of the various agents and intermediaries involved in the home-buying process. From my research I was able to map together the overall flow of involvement and also categorize the stakeholders by whether they were primarily working with the buyer, the seller, or both in tandem. I also placed stakeholders that were only involved once a sale had been agreed upon by the buyer and seller inside the oval, providing a sense of the timing of the stakeholders' involvement.

I approached my customer journey map with a focus on not only the order of actions that compose the home-buying process, but the various systems, emotions, thought processes, and pain points that are part of each stage. From there, I assessed each column and added the potential opportunities for innovation in that stage.

Ultimately what these maps revealed was the complexity in terms of the financial process of buying home. There are so many intermediaries and agents involved just in the financing as well as so many pain points/negative emotions tied to the financial stages in the process that we decided to narrow our focus on alleviating the stress associated with the financing.

Think Aloud Study + Usability Testing

Now that we had formed teams and narrowed down the scope of our solution to be focused on the financial stress associated with buying a home. We wanted to begin by looking at existing resources dedicated to informing people on their finances so we could understand the limitations of the tools out there. We chose to conduct a Think-Aloud study with the website NerdWallet to discover what makes it effective and ineffective in educating young adults on mortgages, loans, and personal saving in preparation for a home. We prepared a series of tasks and had the interviews (our peers from other classes) verbalize their thought process while completing them. From this and a series of post-interview questions, we were able to realize that users want to be able to have resources to learn more about the long-term gains, so they feel more motivated to invest or begin saving.

Contextual Inquiry + Artifact Analysis

We interviewed four recent alumnae of Carnegie Mellon University to discuss their current financial habits. We asked them to come prepared with three artifacts for discussion: what advice their parents gave them, their top 5 financial goals for the next ten years, and the materials they use for their personal budgeting. We learned that how much you pay in rent has a large impact on how much you can save for future home buying. Participants recommended living at home or with roommates to reduce rent. We also learned that there is a desire for a financial planning tool that is geared more towards young adults and their specific spending habits.

Relevant Key Insights:

People want to be more aware of their finances, but they do not want to do all the manual work that comes with organizing.

Young adults have long-term financial goals, but are intimidated by the hurdles associated with investment planning.

Young adults want to eventually buy a home, but with real estate prices skyrocketing, they fear it’s not feasible.

People are more drawn to bigger opportunities to save than small opportunities that could add up.

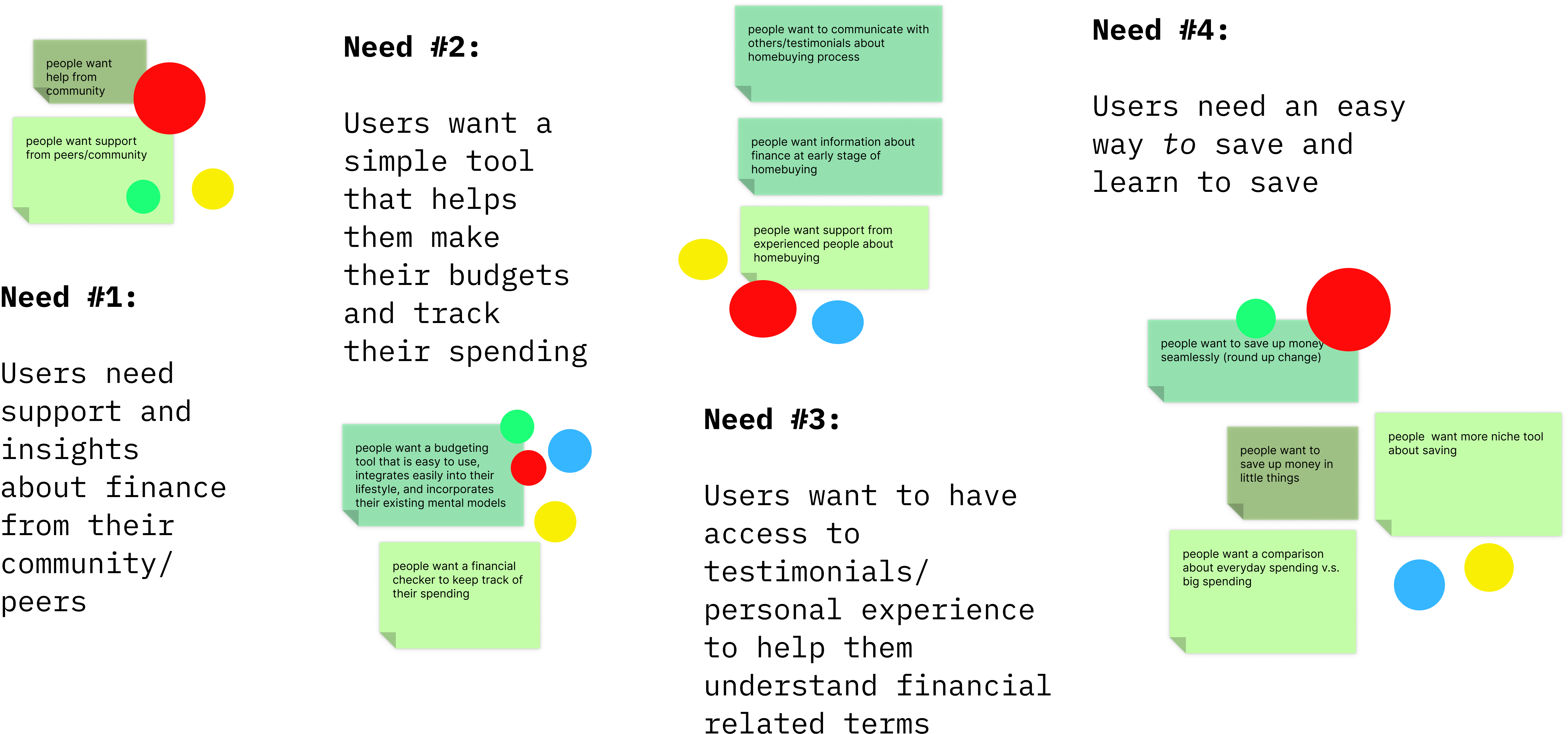

Affinity Diagram + Interpretation Session

Ultimately what my own stakeholder map (as well those of my future teammates) revealed was the complexity in terms of the financial process of buying home.

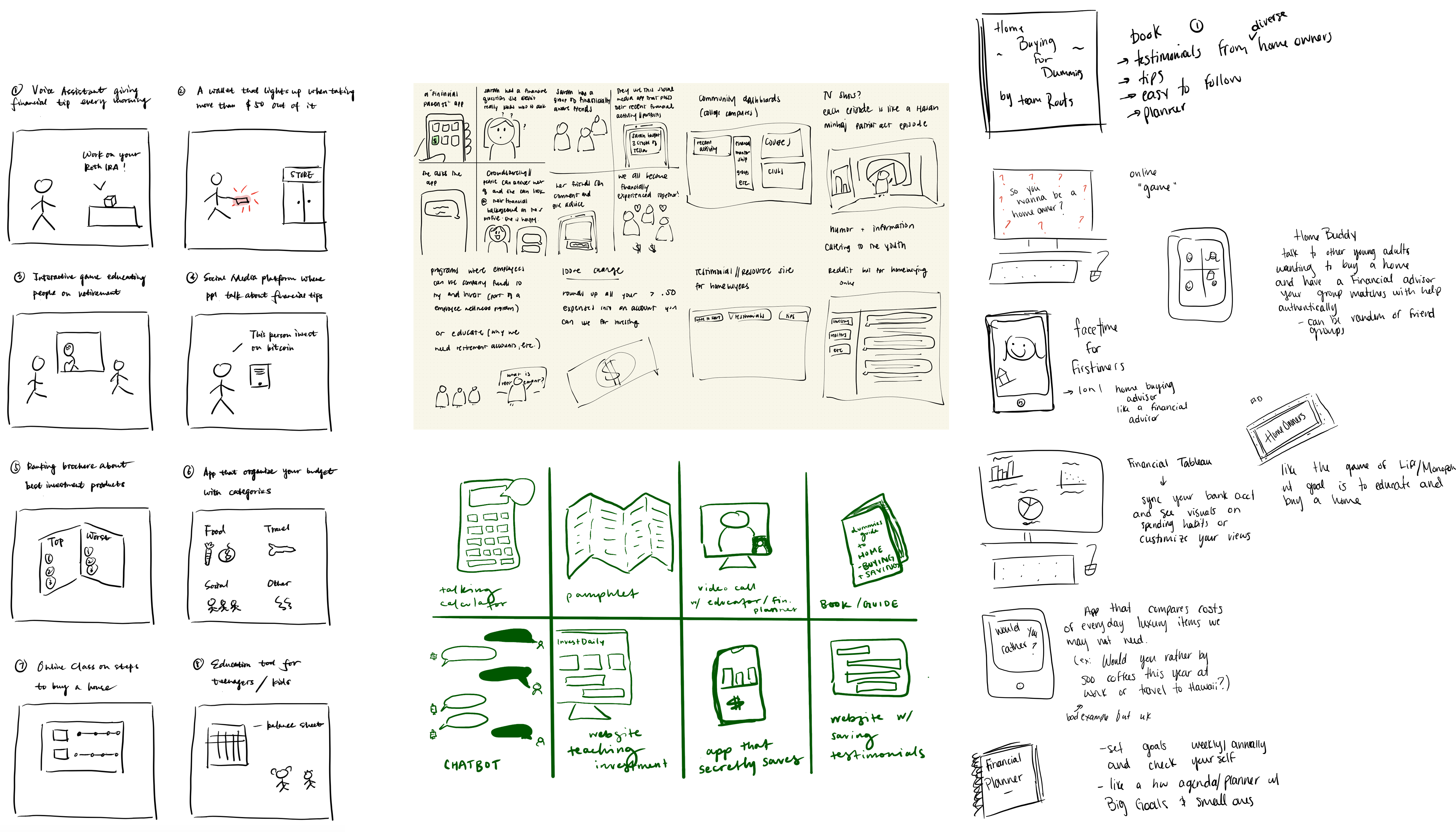

Crazy 8's + Storyboards + Speed Dating

Fresh with all the insights from our affinity diagramming and interpretation session, we started ideating using Crazy 8's -- coming up with 8 ideas each in less than five minutes.

As we discussed our ideas from the crazy 8s, we identified the user need for each idea and noted them down using sticky notes. We then grouped similar needs together using more affinity diagramming and then used dot-voting to determine the top 4 user needs.

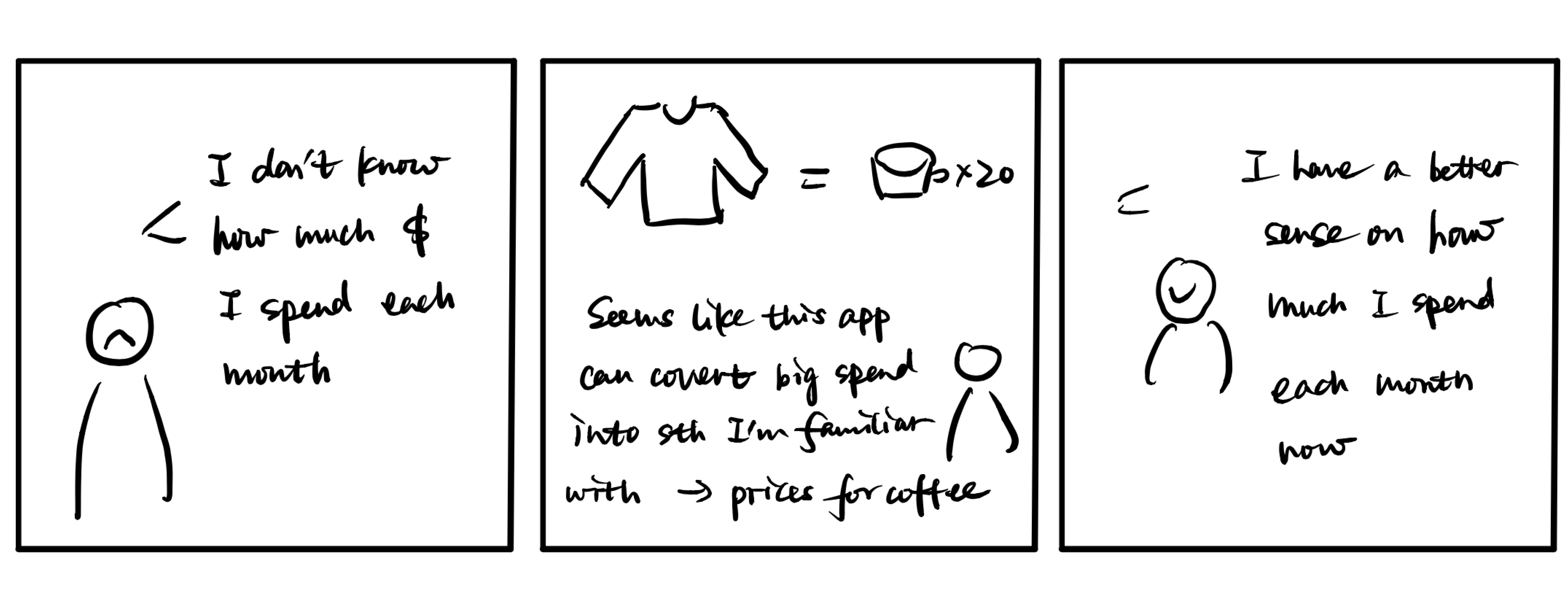

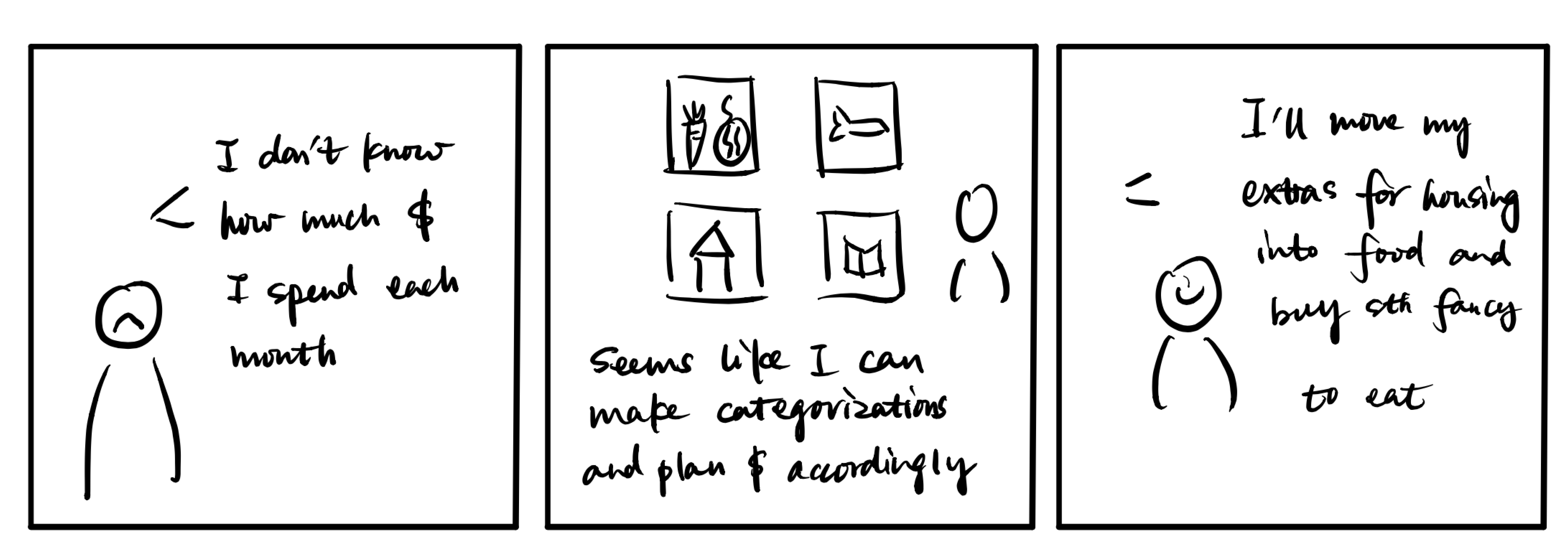

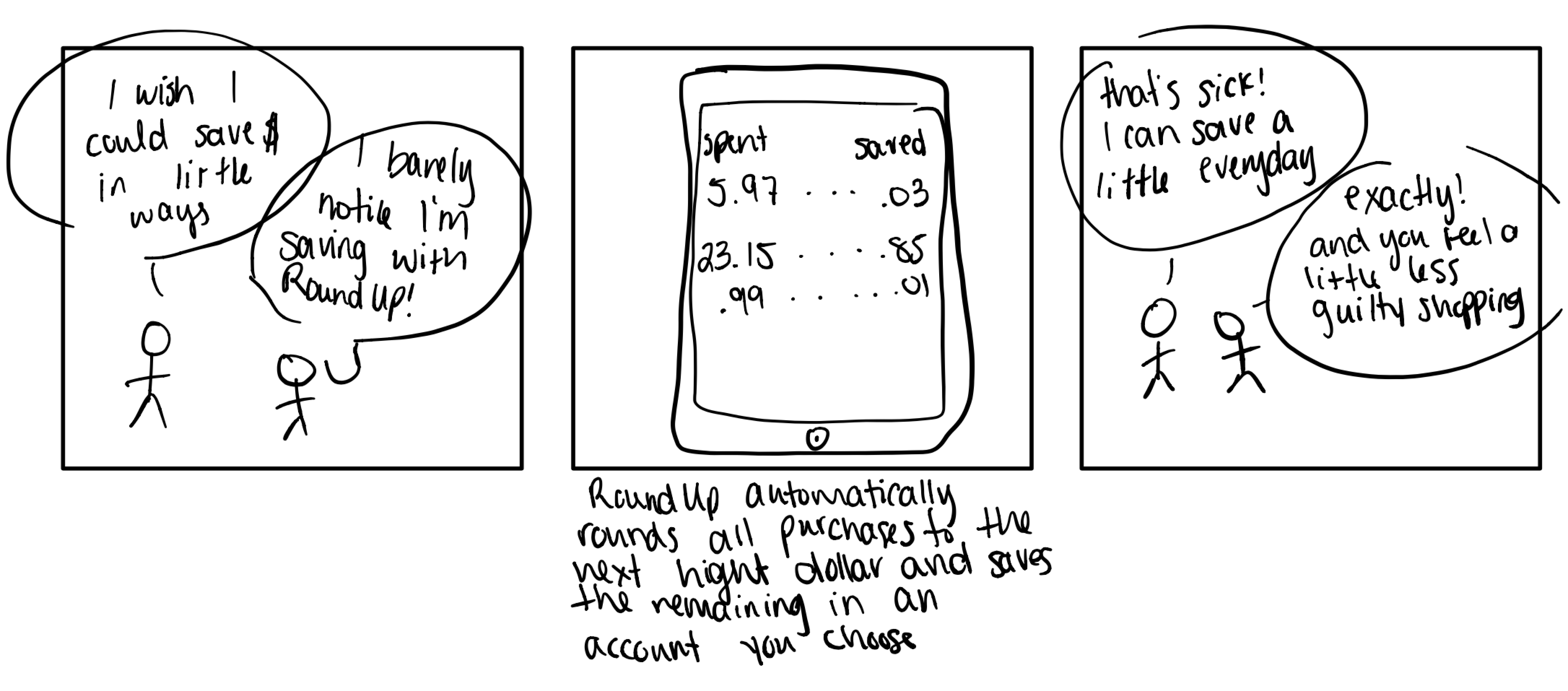

From there we created 3 storyboards for each user need (12 total) and conducted Speed Dating sessions with more young adults in order to determine which user need and which storyboards were the most successful.

Our goal was to start narrowing down what features of a financial planning tool people would appreciate. Our storyboards include a variety of mediums and concepts to try and guage what features of a tool would be most helpful and easy to use. One of our biggest and most telling finds was that people who are first time home buyers would prefer to have advice come from professionals, and they do not prefer testimonials from other ordinary people on the internet. They also believe that finances are too personal of an issue to discuss in depth with strangers in their same position, especially in an online chat setting.

Relevant Key Findings/Opportunities:

All of the participants perceived budgeting as a good habit to have, and they would want some tool to make the process easier.

In terms of saving, participants prefer the “automatic round up” idea where they could use some tool to secretly round up the cost of their purchases to the nearest dollar -- having the change immediately sent to their savings account because that way the entire process is more seamless.

We could create a feature that allows people to organize or reconfigure their savings accounts so that their savings are distributed across different long-term financial goals / expenditures (ex. a rainy day fund, an emergency fund, a dream home fund, etc.)

We could allow the user to see what purchases they make consistently every month or week, so that they can decide for themselves how they want to save based on that information

Above you can see the storyboards that our interviewees resonated with the most. These four ultimately informed our main idea.

Prototyping

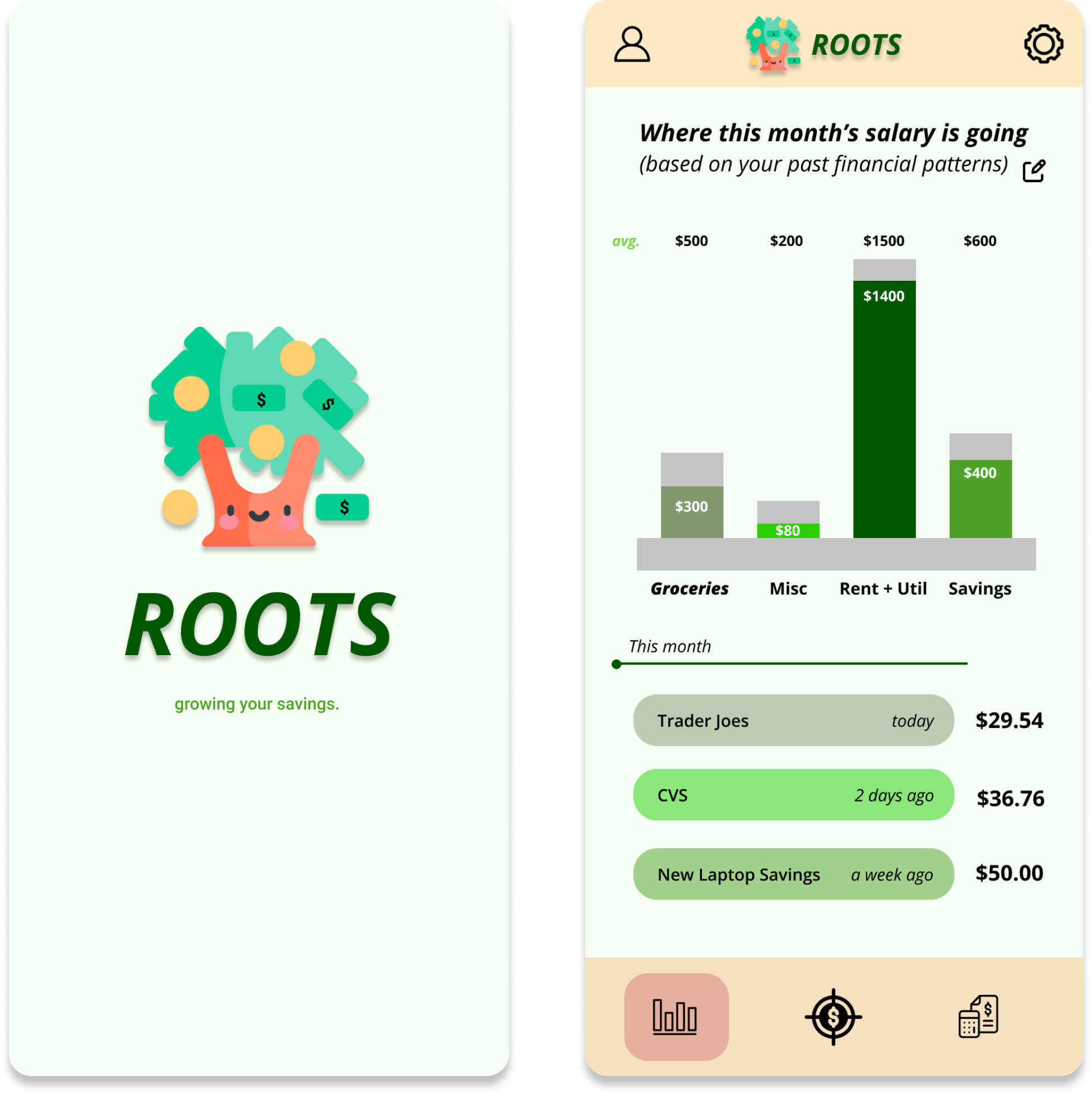

Roots is an financial planning app that gives daily, personalized tips on how to save money to meet the financial goals. It also gives users reminders and budgeting advice on recurring expenses such as rent and groceries. Most importantly, it allow users to customize their financial goals including the amount, the deadline, the priority and the ways to allocate money.

Track Spending

Roots, by accessing your bank account, is able to automatically categorize your transactions and the detect the average amount you allocate to each category, making it quick and easy to budget and see where your salary is going every month.

"It’s really hard to sit down and plug what you’re spending money on into an Excel sheet so a tool that tracked that automatically would be helpful"

Automate Goals

You can set financial goals and automate the allocation of your savings towards those goals, so that you can save with less hassle. You can also organize your goals by priority to ensure that your savings are allocated to the highest priority goals first.

"A more tangible long-term goal would make me feel more motivated to save."

Set Reminders

The SpendingAI feature monitors your transaction history to detect patterns in your purchases so that you can customize notifications to remind you to make smaller sacrifices to save up for upcoming goals you’ve set.

"I did not realize that small everyday spendings such as coffees could add up."