Methods

PESTLE Factors

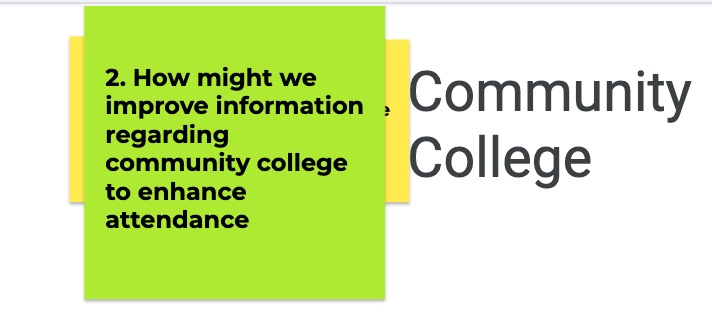

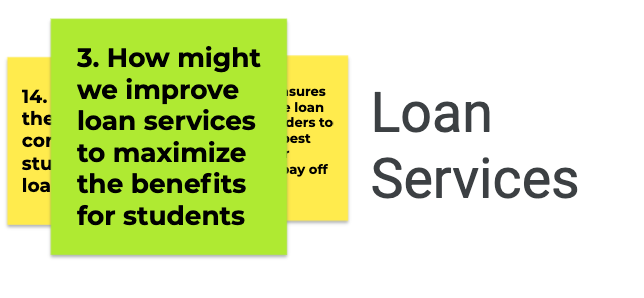

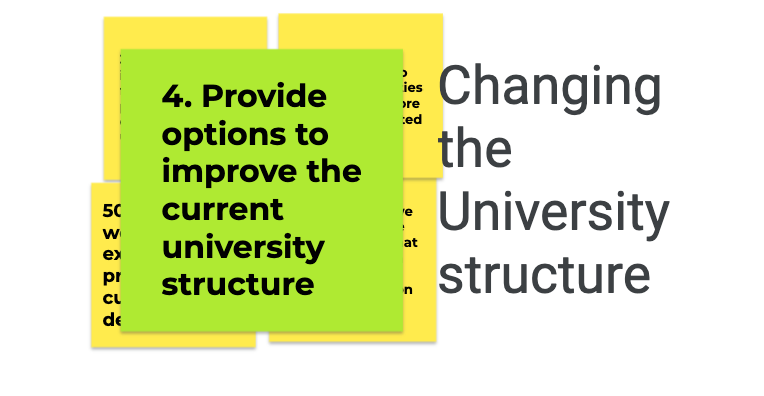

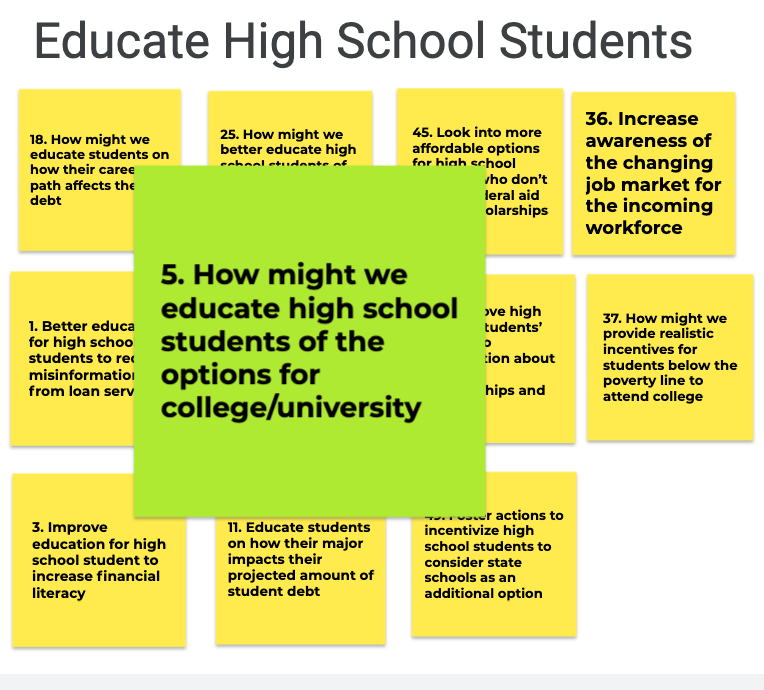

Product Opportunity Gaps

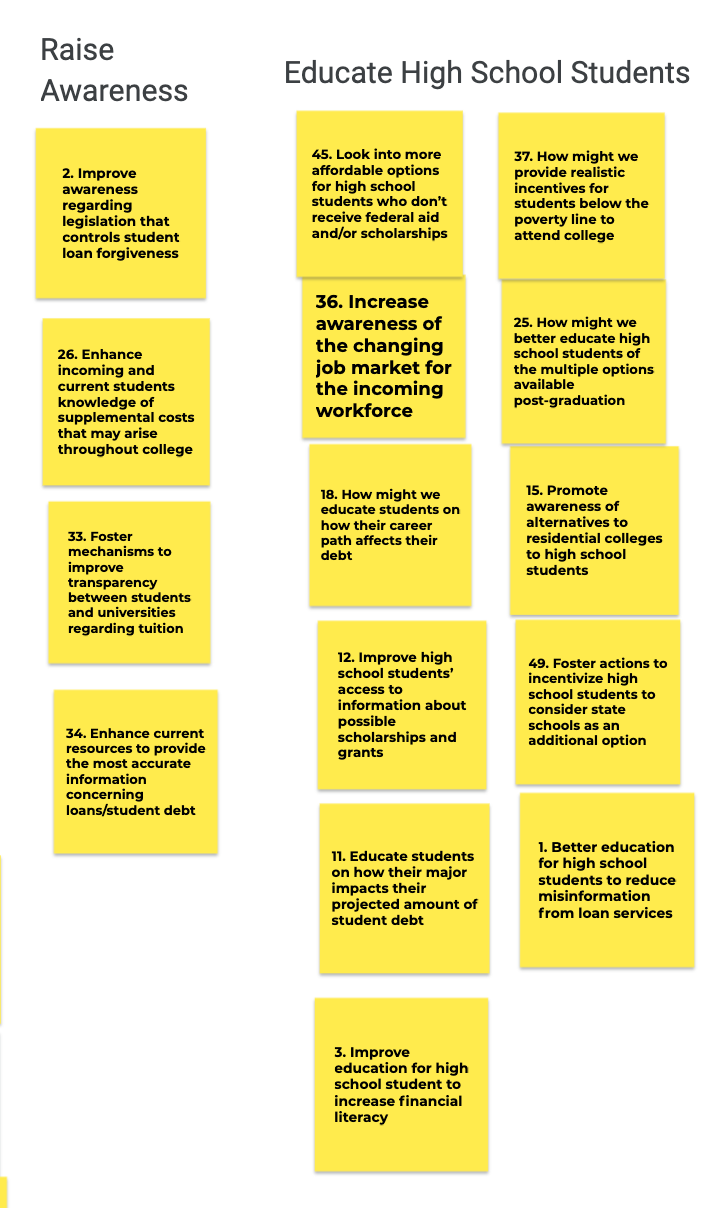

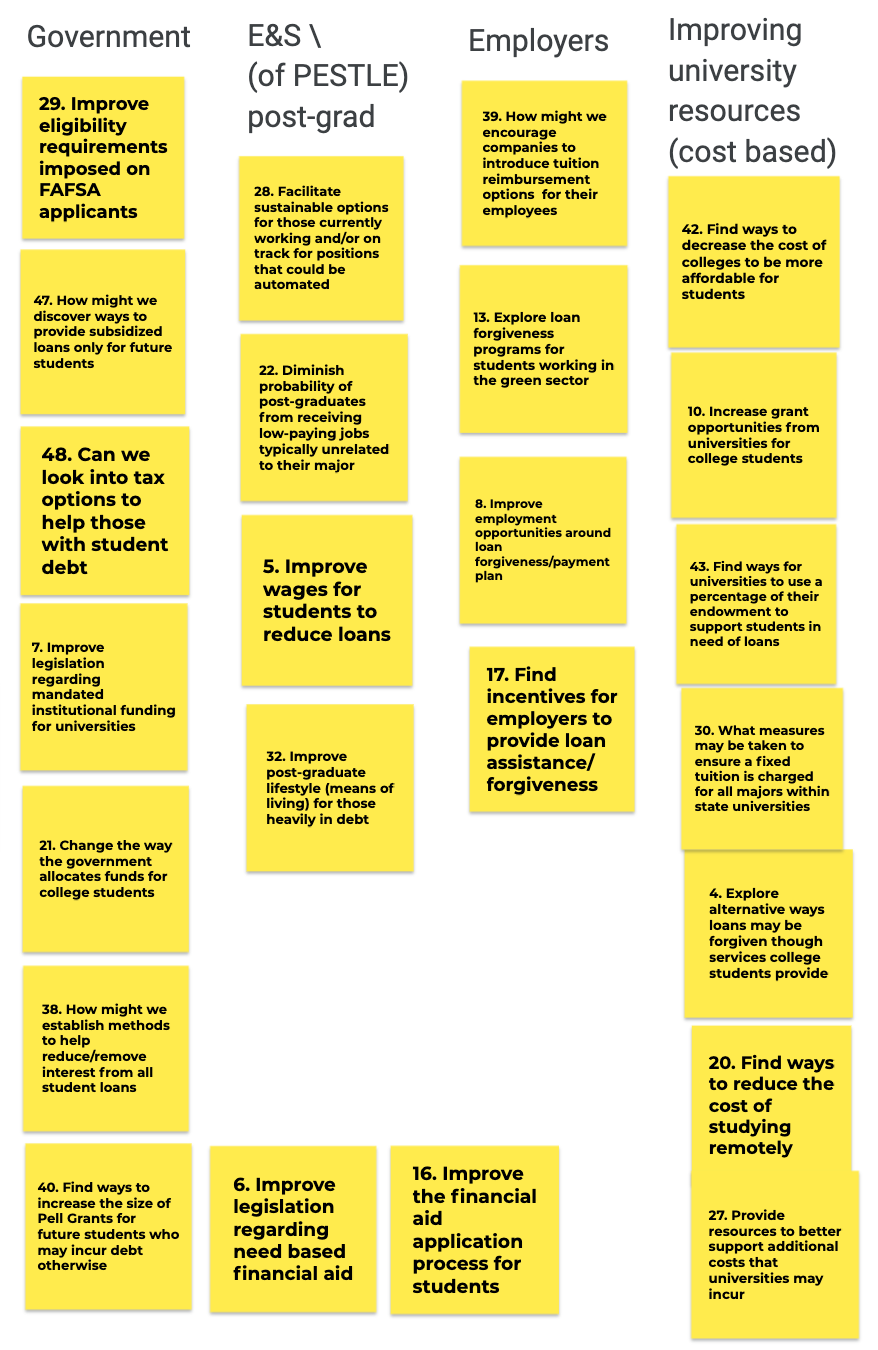

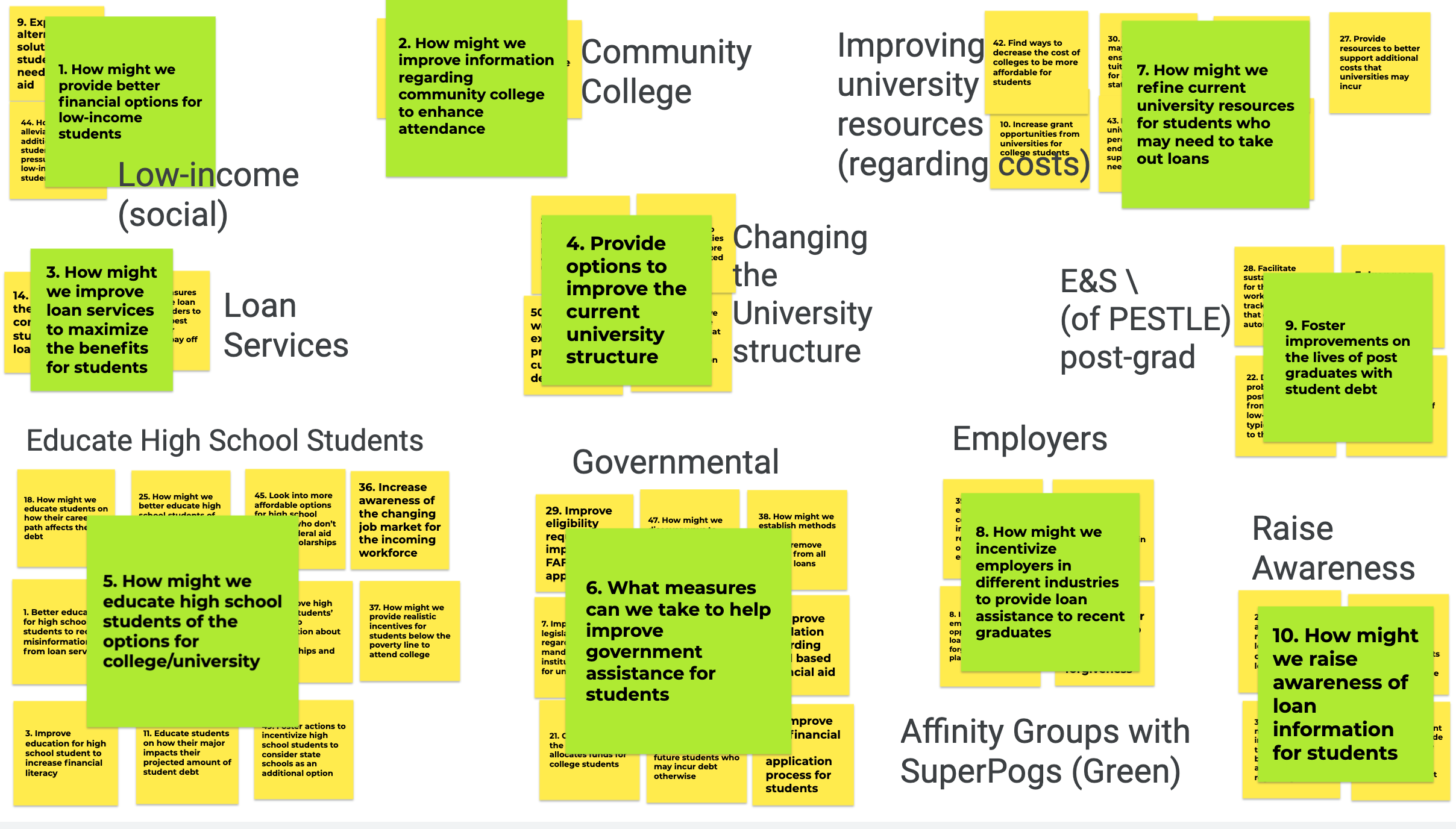

Affinity Diagramming

Opportunity Decision Matrix Analysis

Stakeholder Analysis Map

Semi-structured Interviews

Customer Journey Map

Value Opportunity Analysis

Persona Crafting

Pugh Chart

Reverse Assumptions

Crazy 8s

Wireframing

Tools

Figma

LucidChart

Google Jamboard

Journey + Positioning Maps

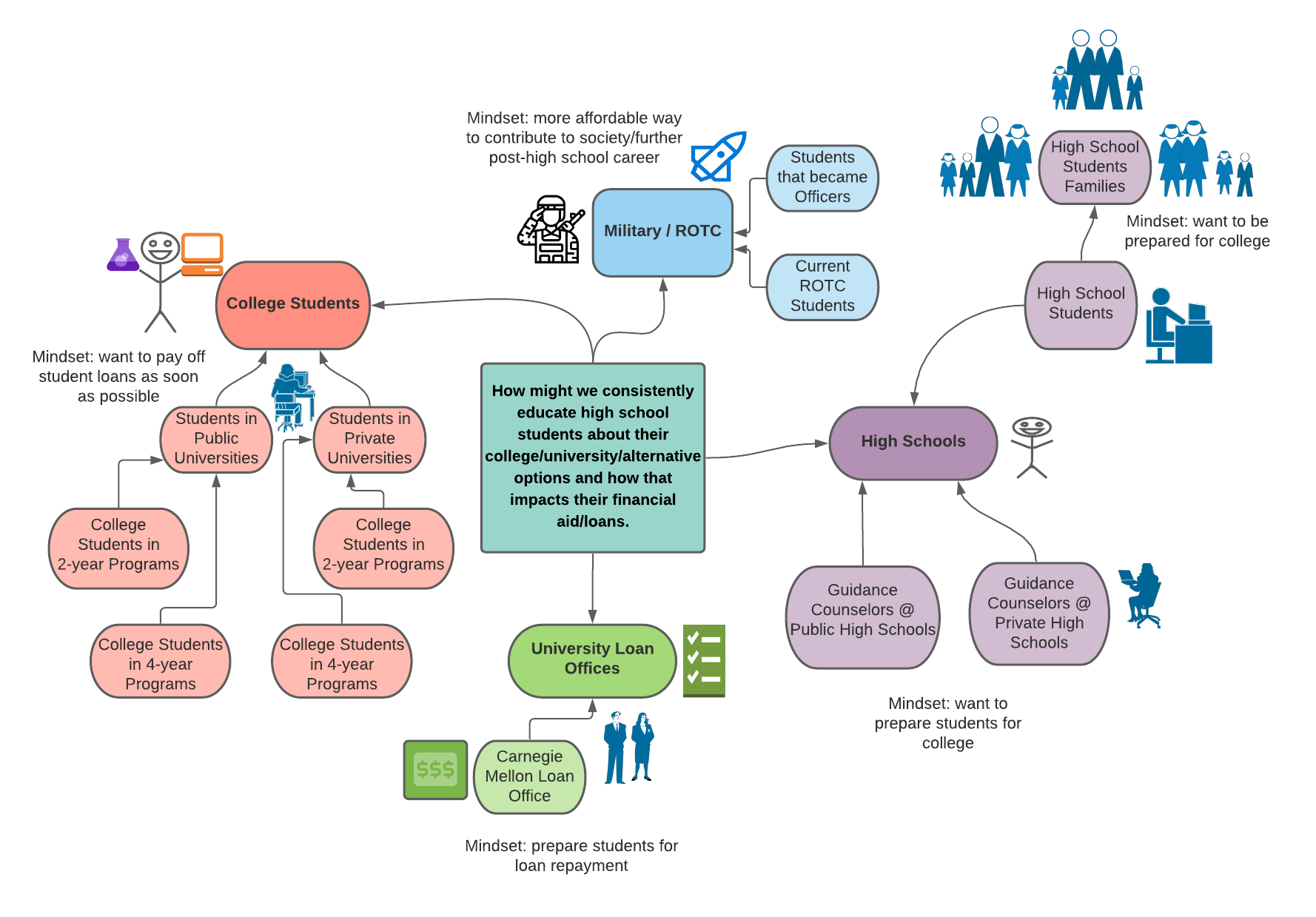

Now that we had identified our key product opportunity gap, we needed to consider the various stakeholders

involved with the process of introducing higher education to high school students.

For our stakeholder journey map, we thought about all the

varius agents that had shed light on our own understanding of higher education while in high school. We began with the

more proximal and obvious stakeholders, like our families, friends (high school and college ones), and guidance counselors.

From there we conducted research into the various paths of higher education, which led us to add stakeholders involved in

the military / ROTC recruitment process. After that, our research was focused on how loan offices can provide

insight to students on the financial weight attached to each form of higher education.

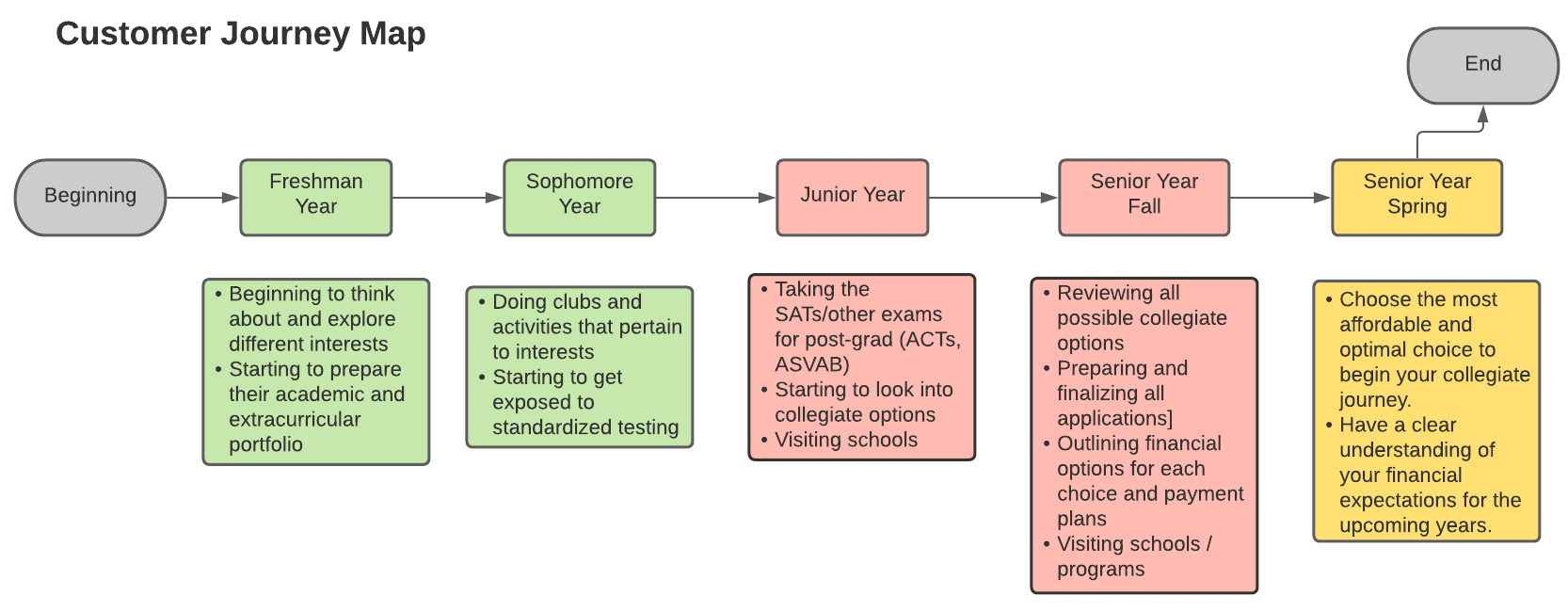

For our customer journey map, in addition to researching online,

we held interviews with high school students to pinpoint the various stages in which they absorb information about higher education,

and understand what priorities exist across the timeline before they decide on their path.

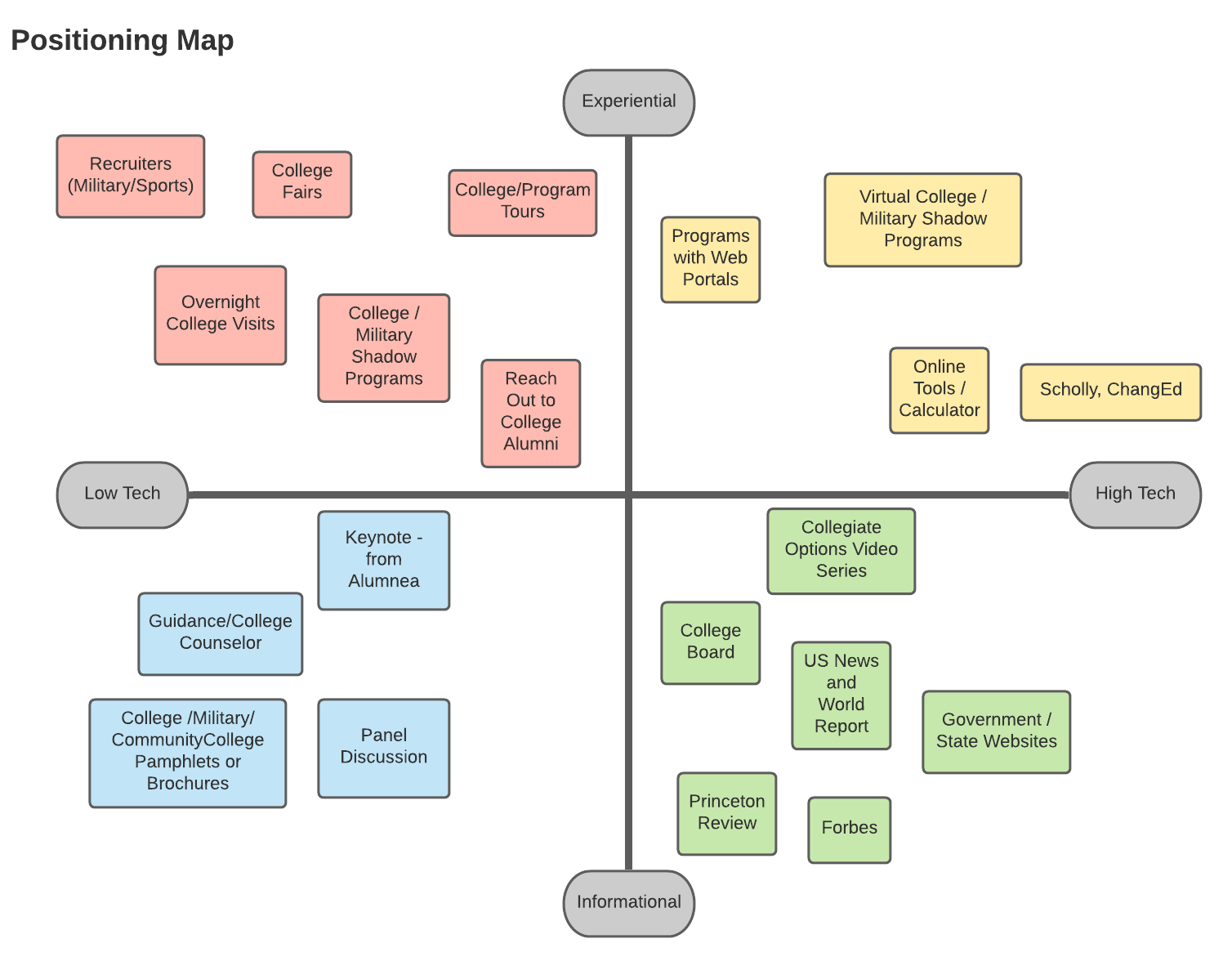

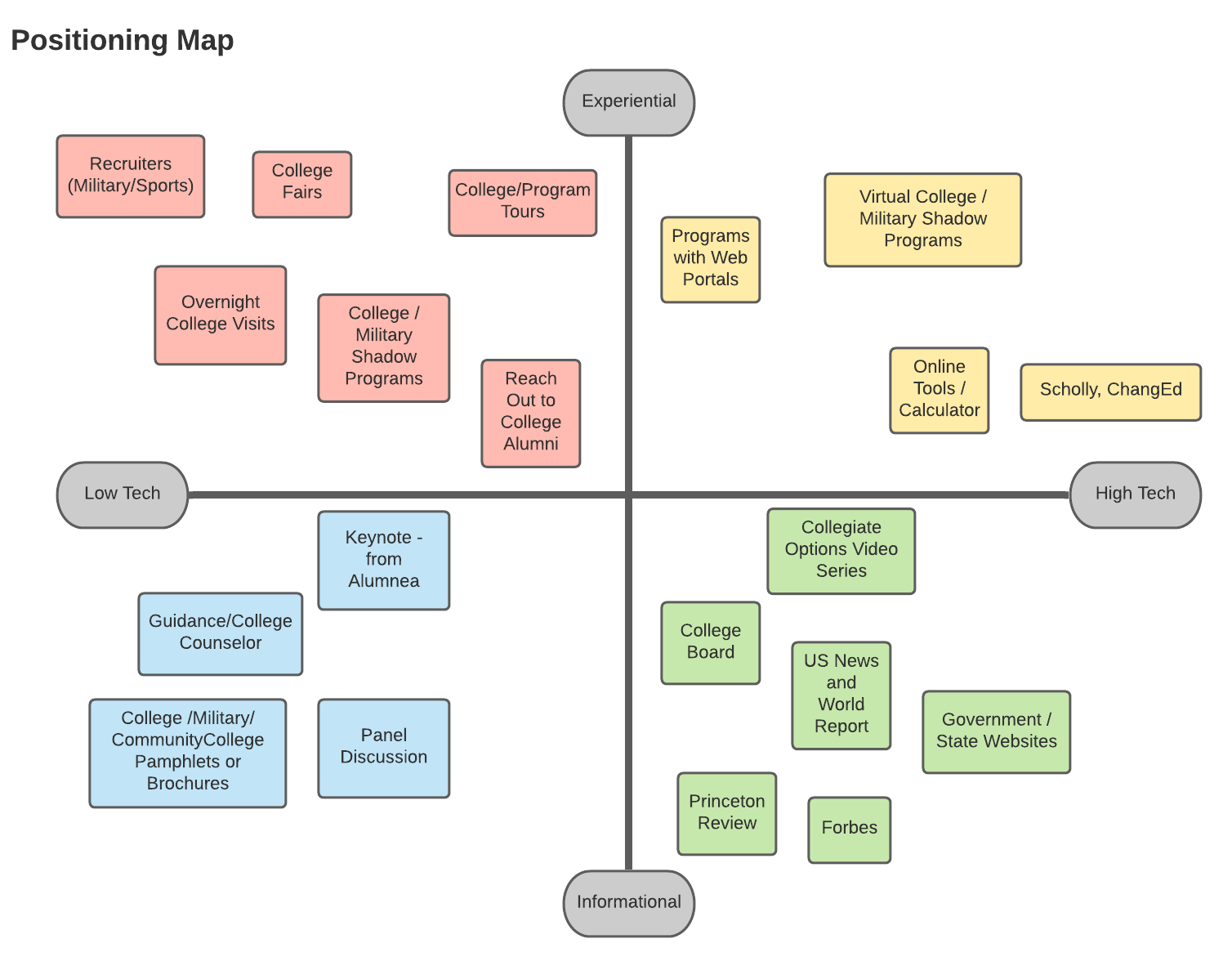

For our positioning map, we used our prior maps to

determine which products / services already exist in the market that are relevant to our problem space,

stakeholders, and customers. We mapped each product / service by how high or low tech it is as well as whether

the product / service is more experiential or informational. We aimed to innovate towards the upper right quadrant,

so we wanted to pinpoint the values attached to the products / services currently in the upper right.

Semi-structured Interviews

We further investigated our POG through interviews and surveys to our stakeholders; high school & college students, guidance counselors, and military troops. Our primary research led to two themed responses.The first is that private colleges are viewed as being so superior in their quality and that high school seniors do not have the capacity to fully understand how much time debt takes to pay back and how much it affects life. From this we determined that our key findings are that it is important to standardly educate high school students about financial options and how those relate to trade/military/4 year college. We also learned that our solution should effectively communicate about the potential incurrence of loan debt and accurately portray how long it will take to pay it off. Our last key finding was to ensure our solution has accessible information surrounding loan debt and higher education options.

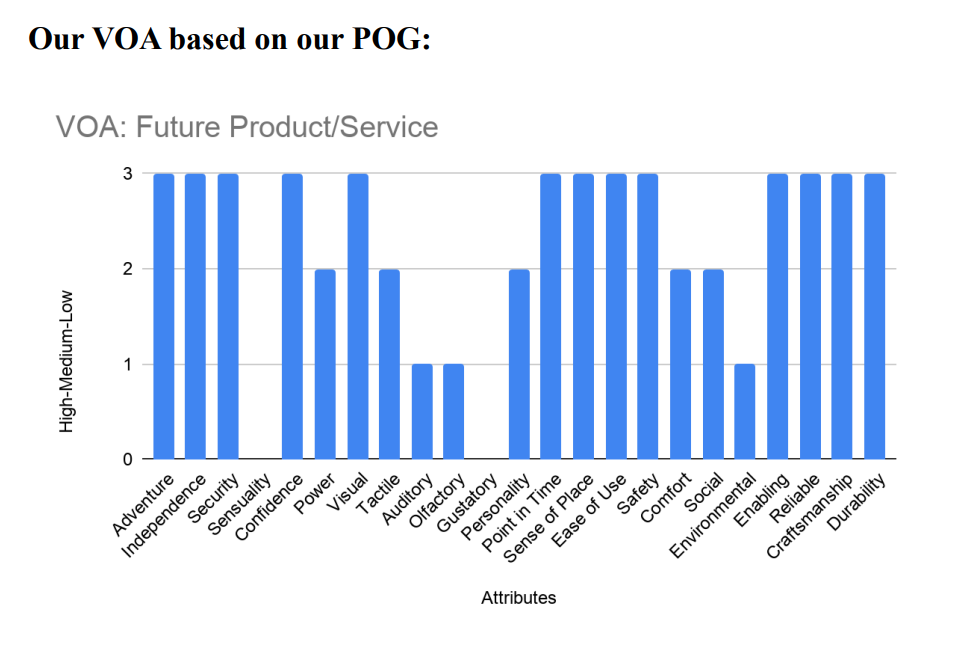

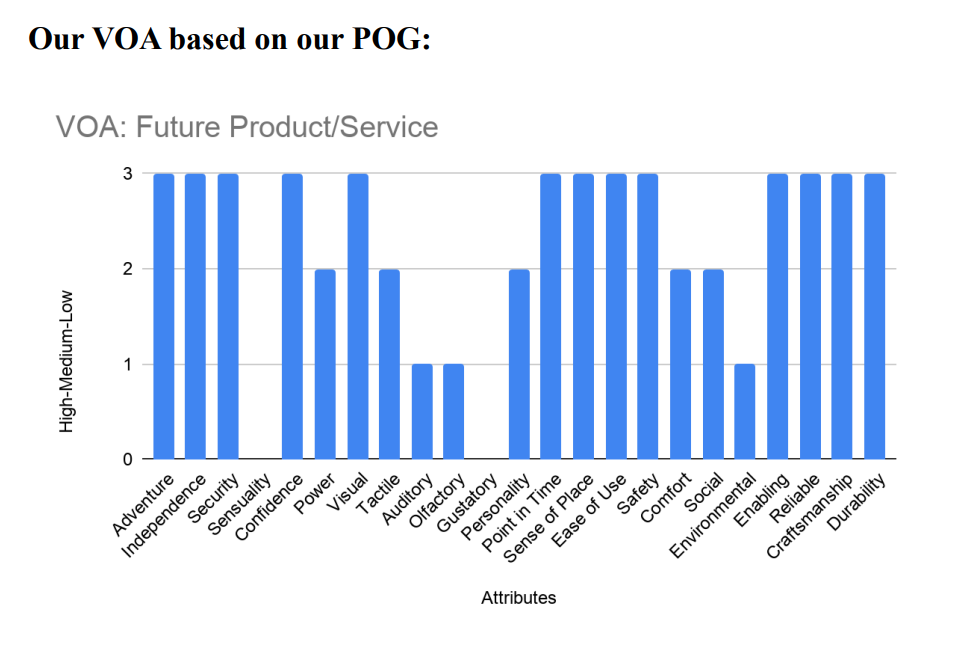

Value Opportunity Analysis

Our next analysis was our Value Opportunity Analysis comparing our goal solution to current FAFSA and Guidance Counselor attributes. After ranking attributes and analyzing the importance of each one we decided on our mandatory product requirements for our solution. These attributes are Security & Safety (protect a key stakeholder’s personal information), Visual & Ease of Use (clearly outlined and easy to use from both a physical and cognitive perspective), Enabling & Durability (enables the key stakeholder to leverage our technology and will last for many years to come), and Point in Time ( aligns with modern times utilizing up-to-date technologies, information, features, and aesthetics).

Ideating

To conceptualize a solution we decided to employ numerous ideating strategies in our brainstorming sessions

(crazy 8's, Reverse Assumptions, Bad Ideas List, etc.) before finally analyzing and developing our top 3 concepts.

Our top concepts ended up being H.E.L.P -- Higher Education Learning Platform -- a data-driven website

filled with clear information of a variety of college and financial aid options;

Community-Wide Hub, community center of guidance counselors that help students explore post high-school options;

and a “Day in the Life” program, an experiential college opportunity. Our final concept ended up being the

Higher Education Learning Platform (HELP). HELP is an online tool to help high school students navigate

collegiate choices based on a database that analyzes the academic, social, and financial attributes of

each post graduation option. Through this tool students would have access to the most up to date information,

financial literacy education, and remote & in-person college experiential programs. The goal of this

platform is to expand the mindsets of high school students and grant them the opportunity to look into

more feasible college options that might have not been considered.

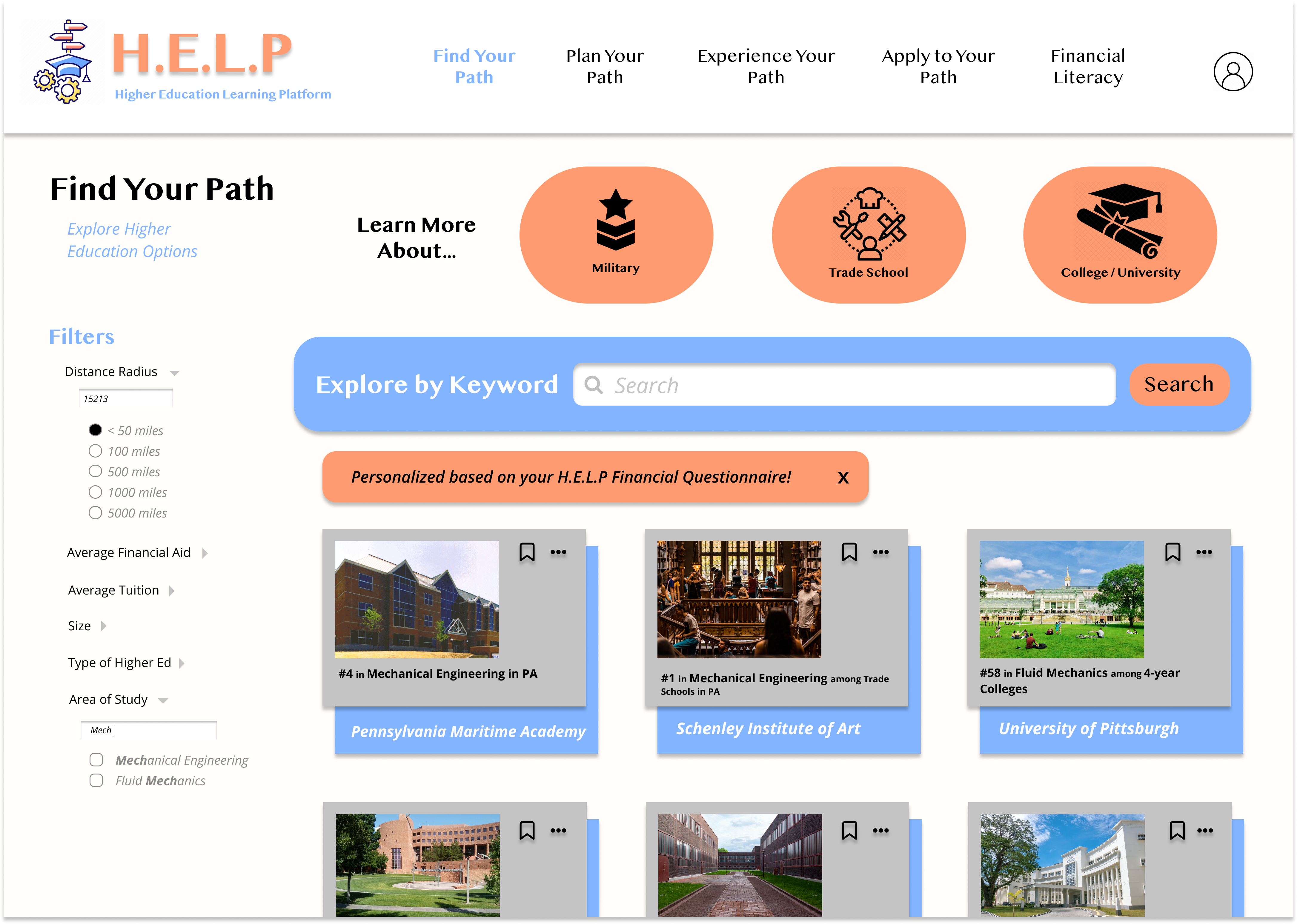

Wireframing

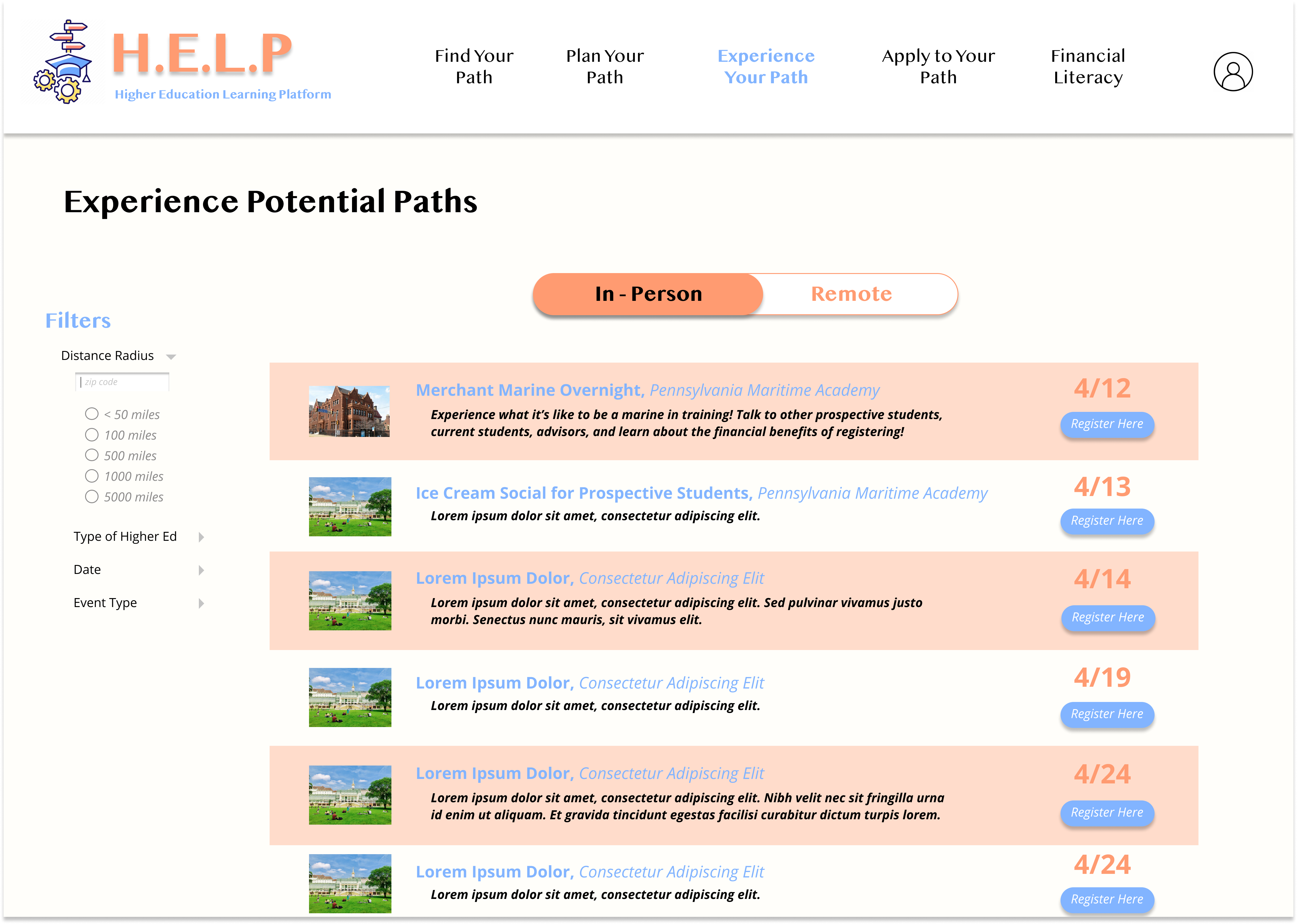

From there, my individual contribution to our final deliverable was wireframing H.E.L.P.

H.E.L.P would facilitate the process of finding information about different avenues for higher education,

by consolidating access to registration to information sessions for each path. Here in this wireframe, you can see

that any student can filter the available information sessions (remote or in-person) and quickly view the dates and

navigate to the registration form.

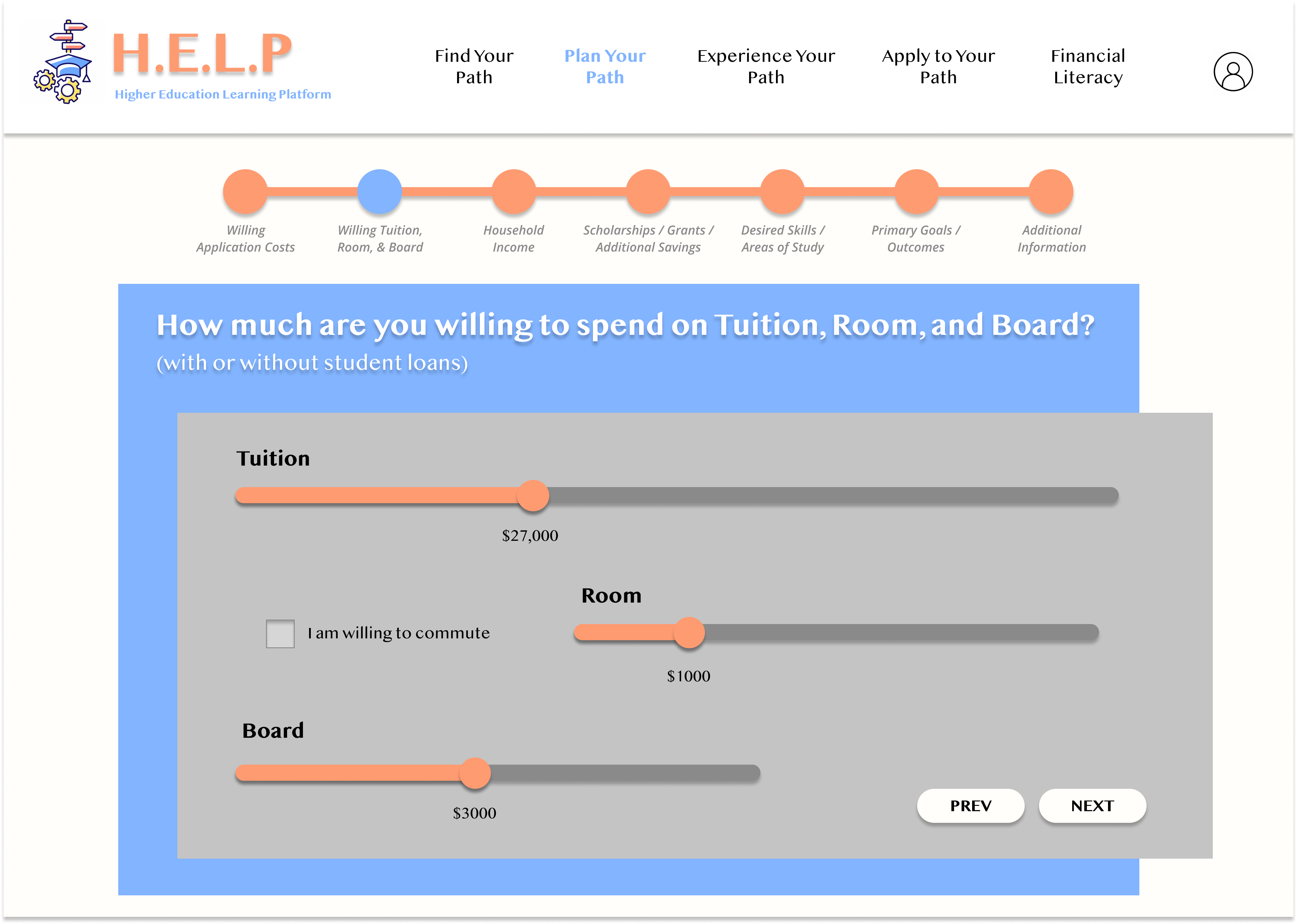

H.E.L.P can be personalized to each student through its financial questionnaire which provides students insight into

the various financial factors they need to consider when deciding upon higher education and from there points them

towards options that suit their ideal financial status upon graduation or completion.

Here you can see the output of the financial questionnaire -- a list of higher education paths that take into account the

financial goals of the student. This page also exists regardless of whether or not the financial questionnaire is filled out,

but just lists all the potential higher education options out there. You can also filter the results further by distance, area of study,

average financial aid, etc.

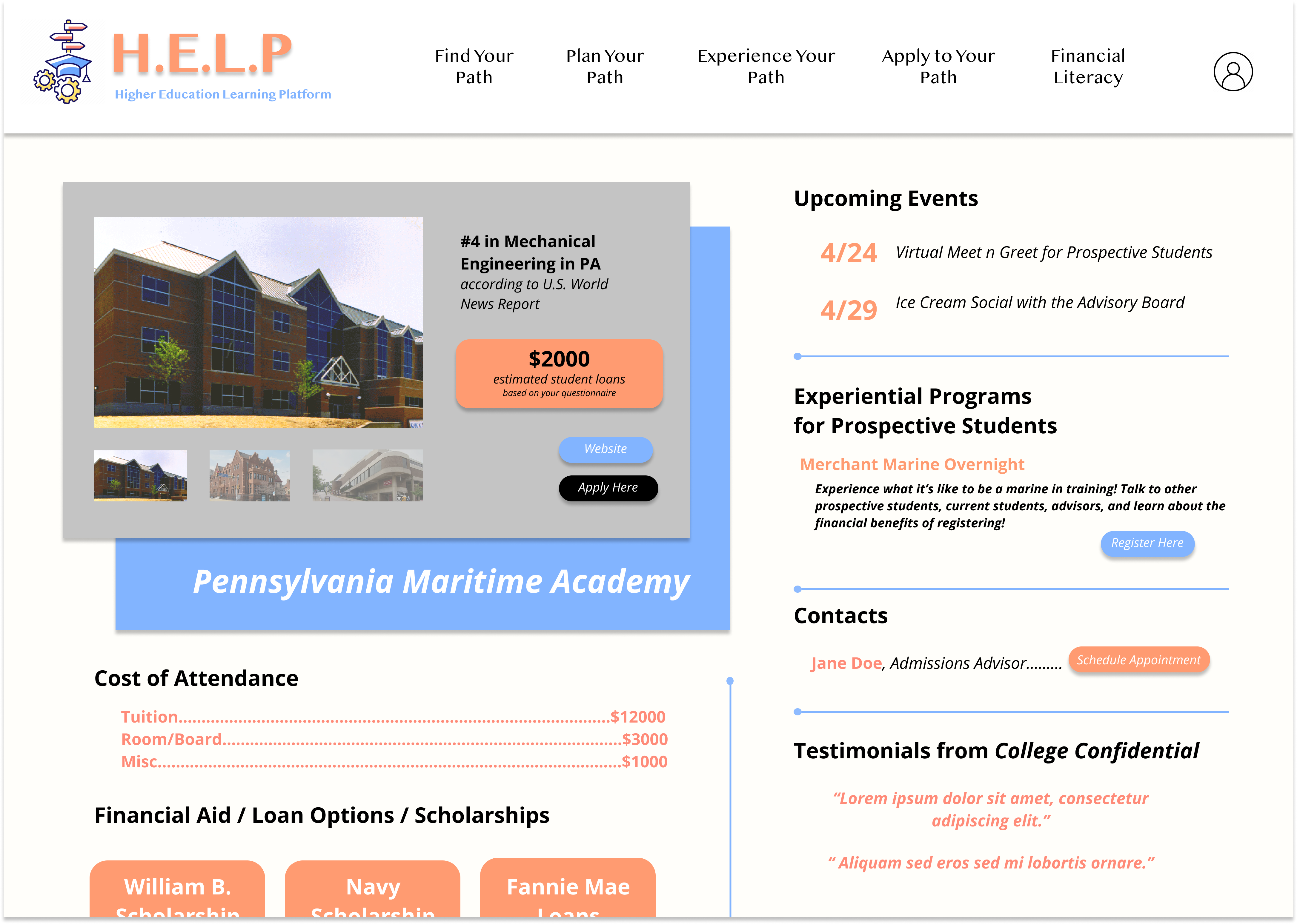

Once you click on one of the higher education options, you navigate to a page with more details about the path. Here

you can see the cost of attendance, known financial aid options, upcoming events, experiential programs if available,

contacts, and testimonials in addition to links to the higher education option's website.

Ultimately our goal with this site was to provide more transparency to students about their options for higher education.

For some students, the financial weight attached to traditional college / university often dissuades them from

even considering higher education at all, so having the ability to customize your search and educate yourself on the

not only all the financial considerations involved, but all the various paths out there is extremely valuable.